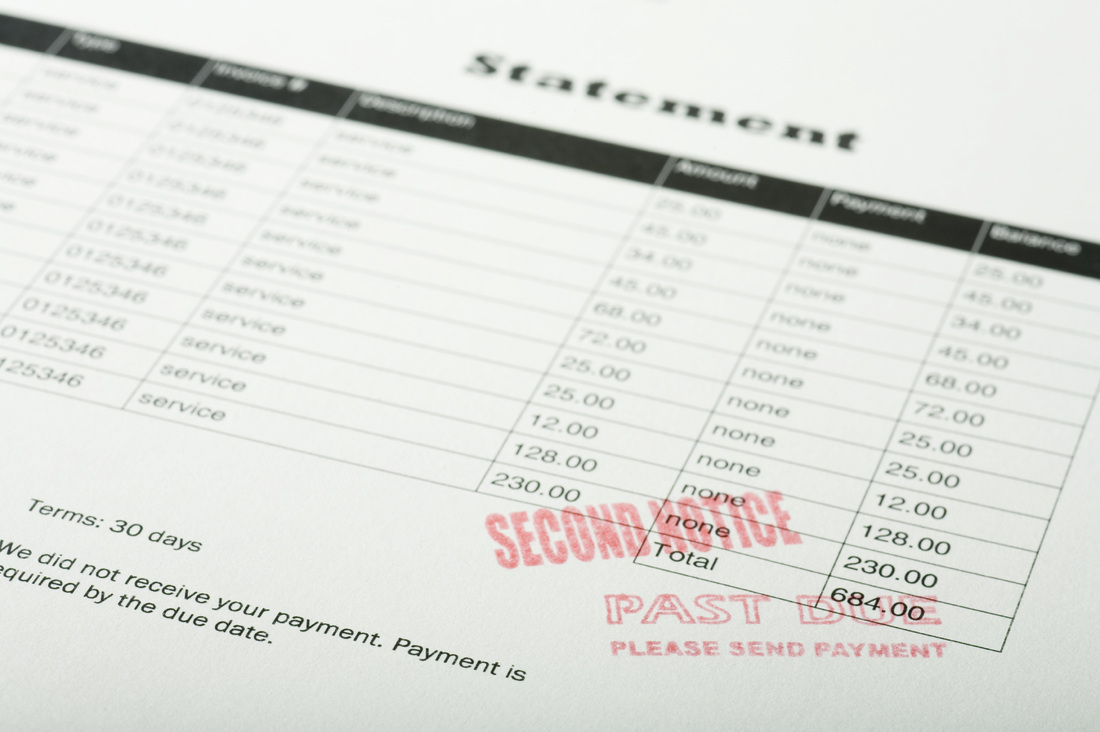

This past week, the major credit reporting agencies announced sweeping changes to the way they will be reporting and handling many aspects of their daily business. These changes are generally for the benefit of consumers, which is great for all of us personally, but how does it affect your accounts receivables and unpaid balances?

First of all, what are the basics to these changes? They revolve around the way bureaus handle disputes concerning unpaid bills, and will make it easier and faster to correct mistakes on a consumer’s credit report. It will also provide a longer window for medical charges to affect credit score, and will change what types of charges show up on a report. Overall, it gives customers some relief and expediency in the way their credit scores are handled, which can affect their ability to get a loan, a cell phone contract, or in some cases even a job.

Let’s look into this a little further:

·Disputes: In the past, if an alleged delinquency showed up on a customer report, the burden of proof fell to the customer, while the bureau was more likely to take cues from the creditor. Now, credit bureaus will be staffing up to better investigate disputes, and creditors will be held to more rigorous documentation standards.

·Medical Debt: Credit Reporting agencies will now be extending the waiting period for reporting medical delinquencies to 180 days. The extra time will allow for insurance companies to apply payments to the total bill, a process where delays often cause creditors to issue a credit hit prior to receiving insurance funding.

·Retroactive Medical: The bureaus have also agreed to expunge previously reported medical balances that have since been paid or will be paid by insurance, rather than allowing them to sit on a customer’s report for the standard 7 years.

·Charge Types on Reports: Items such as parking tickets or payday/check cashing loans will no longer show up on credit reports.

·Greater Transparency and Education: If a customer has a dispute, they will have access to more educational content and information about their case, and will be entitled to an additional free credit report upon completion of their dispute if a change in credit takes place.

·Timeline: Changes will begin to take effect over the next few months, with some of the more involved changes being implemented over the next year.

What does that mean for your business and your customer? It makes documentation and pursuit of unpaid income more important than ever. If your records are not fully in order, it’s time to take a ‘state of the union’ on your internal processes and make a plan in preparation for disputes as they arise.

If a customer feels less of a threat from taking a credit hit, they may be less likely to pay an outstanding balance without continuous prompting. You can rest easy if you are already a current client of TekCollect - you already experience industry-leading documentation, reporting, and effective pursuit as part of our standard services. We pride ourselves on exceeding the new credit bureau requirements, and are always looking ahead of the curve.

Article Sources: Los Angeles Times, Fox Business, Chicago Tribune

TekCollect provides the most advanced accounts receivable, collections, and client retention services available. To learn more about us, visit our website and follow us on Facebook and Twitter.

First of all, what are the basics to these changes? They revolve around the way bureaus handle disputes concerning unpaid bills, and will make it easier and faster to correct mistakes on a consumer’s credit report. It will also provide a longer window for medical charges to affect credit score, and will change what types of charges show up on a report. Overall, it gives customers some relief and expediency in the way their credit scores are handled, which can affect their ability to get a loan, a cell phone contract, or in some cases even a job.

Let’s look into this a little further:

·Disputes: In the past, if an alleged delinquency showed up on a customer report, the burden of proof fell to the customer, while the bureau was more likely to take cues from the creditor. Now, credit bureaus will be staffing up to better investigate disputes, and creditors will be held to more rigorous documentation standards.

·Medical Debt: Credit Reporting agencies will now be extending the waiting period for reporting medical delinquencies to 180 days. The extra time will allow for insurance companies to apply payments to the total bill, a process where delays often cause creditors to issue a credit hit prior to receiving insurance funding.

·Retroactive Medical: The bureaus have also agreed to expunge previously reported medical balances that have since been paid or will be paid by insurance, rather than allowing them to sit on a customer’s report for the standard 7 years.

·Charge Types on Reports: Items such as parking tickets or payday/check cashing loans will no longer show up on credit reports.

·Greater Transparency and Education: If a customer has a dispute, they will have access to more educational content and information about their case, and will be entitled to an additional free credit report upon completion of their dispute if a change in credit takes place.

·Timeline: Changes will begin to take effect over the next few months, with some of the more involved changes being implemented over the next year.

What does that mean for your business and your customer? It makes documentation and pursuit of unpaid income more important than ever. If your records are not fully in order, it’s time to take a ‘state of the union’ on your internal processes and make a plan in preparation for disputes as they arise.

If a customer feels less of a threat from taking a credit hit, they may be less likely to pay an outstanding balance without continuous prompting. You can rest easy if you are already a current client of TekCollect - you already experience industry-leading documentation, reporting, and effective pursuit as part of our standard services. We pride ourselves on exceeding the new credit bureau requirements, and are always looking ahead of the curve.

Article Sources: Los Angeles Times, Fox Business, Chicago Tribune

TekCollect provides the most advanced accounts receivable, collections, and client retention services available. To learn more about us, visit our website and follow us on Facebook and Twitter.

RSS Feed

RSS Feed